Insulation tax credits are government-provided financial incentives. Their goal is to motivate homeowners to invest in energy-efficient upgrades, particularly insulation improvements. The underlying idea is simple: by enhancing a home’s insulation, energy consumption is reduced. This leads to lower utility bills and decreased greenhouse gas emissions. As an extra incentive, governments offer tax credits to eligible homeowners, which can lead to significant savings on income tax.

The way insulation tax credits work is relatively straightforward. When homeowners make eligible energy-efficient upgrades to their properties, such as adding or improving insulation, they can claim a portion of the expenses as a tax credit when filing their income tax returns. Unlike deductions that lower the amount of taxable income, tax credits provide a direct reduction in the amount of tax owed, resulting in tangible savings.

Attention should be given to the alterations made to Residential Energy Tax Credits in 2023.

Checking Your Eligibility for Insulation Tax Credits

Residential Requirements

Typically, insulation tax credits are aimed at encouraging energy-efficient upgrades in primary residences and not for rental or investment properties. They are primarily designed for homeowners who wish to make energy-efficient improvements to the house they live in most of the time rather than a vacation property or rental house.

For this reason, the claimant should be the actual homeowner of the property; people who rent their homes or those living with family or friends are unfortunately ineligible for these credits.

There may be additional caveats relating to the age of the property. Certain tax credits may have stipulations tied to the construction date, and could either exclusively apply to homes built before a specific year or exclude newly constructed properties.

Furthermore, eligibility for insulation tax credits can depend on the specific location of the property. Different countries or regions may impose distinct requirements, often determined by the local climate and the energy-efficiency initiatives that are active in that particular area.

Tax Credit Limitations

While insulation tax credits offer fantastic benefits, there are some limitations that you should be aware of.

Insulation tax credits are typically designed to cover a specific percentage of the total cost associated with qualifying insulation upgrades, up to a predetermined limit. So, claimants shouldn’t expect a dollar-for-dollar credit for the entire expenditure.

The government may also impose a maximum credit amount that can be claimed for insulation enhancements. As an example, you might be eligible to claim up to $500 or a certain percentage of the overall expense — whichever is less.

Another limitation is that insulation tax credits typically function as one-time benefits. Once the credit for a particular year is claimed, it can’t be used again for the same upgrades in any subsequent tax returns.

Finally, insulation tax credits often come with expiration dates. To avail of the benefits, you must complete the qualifying upgrades and make the claim within a defined time frame.

Previous Credit Claims

Have you previously claimed insulation tax credits or other energy-related credits? If so, this may impact your eligibility for future benefits.

Governments may set lifetime limits on the aggregate amount of energy-related tax credits that one can claim. If you’ve already reached the stipulated maximum, you’ll be ineligible for further credits.

Also, there may be restrictions when it comes to previously used products. For instance, if you’ve already availed credits for certain insulation upgrades, you may be barred from claiming them again, even if you decide to further enhance the same areas.

Additionally, investigate whether your energy tax credits permit unused portions to be rolled over to upcoming years. Such an option, if available, could potentially result in long-term savings.

To ensure you meet all the eligibility criteria and make the most of insulation tax credits, consider consulting with a tax professional or researching the specific guidelines provided by your government. You can also contact Pure Eco Inc regarding these matters in Los Angeles and California.

How to Qualify for Insulation Tax Credits – Your Pathway to Energy Savings and Eco-Friendly Living

Qualifying for insulation tax credits involves meeting specific criteria set by the government to ensure that homeowners make energy-efficient improvements. By following these guidelines, you can not only enjoy the benefits of reduced energy bills but also contribute to a greener and more sustainable future.

- Meeting Energy Efficiency Standards

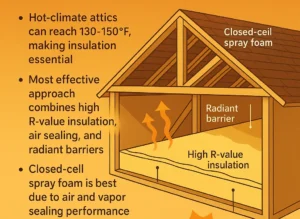

To qualify for insulation tax credits, start by assessing the current insulation status of your home. Look out for areas where insulation might be insufficient or missing, such as attics, walls, basements, and crawl spaces.

Next, identify the specific areas in your home that could benefit the most from insulation enhancements. Pay special attention to spaces that are prone to significant heat loss or gain, as upgrades in these areas will contribute the most to your home’s overall energy efficiency.

Before starting, understand the energy efficiency standards and requirements as laid out by your government or tax authority. Keep in mind that different regions may impose varying standards that homes must meet to be eligible for the credits. Once you’ve done your research, choose insulation materials that satisfy or surpass these prescribed energy efficiency standards. Seek out products that boast high R-values, which signify superior thermal resistance and effectiveness in inhibiting heat transfer.

- Using Certified Products

When you’re in the process of purchasing insulation materials, check for certification labels or marks from well-known organizations. Programs such as ENERGY STAR® indicate that the products have been evaluated and meet the industry standards for energy efficiency and performance. Products with this certification adhere to stringent energy efficiency guidelines and can significantly increase your chances of qualifying for tax credits.

Some government agencies provide handy lists of insulation products and manufacturers that qualify for tax credits. Ensure that the products you’ve chosen are included in these lists to avoid any potential issues during the claiming process.

If you find yourself uncertain about which insulation products fulfill the necessary standards, don’t hesitate to seek professional advice. Energy efficiency experts or insulation contractors can provide valuable guidance in selecting the right materials for your home.

- Seeking Professional Installation

To maximize the benefits of insulation tax credits, consider hiring certified and experienced insulation contractors for the installation process. The effectiveness and performance of the insulation largely depend on its proper installation, which, in turn, ensures it meets energy efficiency standards.

In addition, verify the qualifications of your chosen installation company. A licensed, insured, and well-reputed company such as Pure Eco won’t just enhance your chances of qualifying for tax credits but also assure quality workmanship that delivers lasting results.

Lastly, consider scheduling a home energy audit. This audit, conducted by a certified energy auditor, helps identify areas that might need insulation upgrades. The auditor can also assess your home’s overall energy performance and recommend the most suitable insulation solutions.

Claiming Insulation Tax Credits – Steps to Unlocking Your Energy Savings

To make the claiming process smooth and hassle-free, start by keeping meticulous records including receipts, invoices, and any documentation linked to the purchase and installation of insulation materials. Such documents will prove invaluable when the time comes to claim the tax credits. They should unambiguously state the details of the products, the dates of purchase, and the total expenses.

You should also secure the necessary certification labels or documentation from the insulation manufacturer. This evidence attests that the products used are in compliance with the required energy efficiency standards.

If you’ve had a home energy audit done to assess your insulation needs, retain a copy of the audit report. This report serves to justify the necessity of the upgrades undertaken and helps validate your claim for tax credits.

Finally, maintain a record of your insulation contractor’s contact details. Information such as their name, business address, and tax identification number will be necessary when you file your claim.

Filing Options: Form 5695

To claim insulation tax credits, you’ll need to complete and submit IRS Form 5695 – Residential Energy Credits. This form lets you compute the total credits you’re eligible for, based on the energy-efficient upgrades you’ve made.

When filing, attach all the necessary documentation you’ve compiled as supporting evidence for your claims. The receipts, manufacturer certification, and energy audit reports will corroborate your eligibility and the claim amounts.

You have the option to file Form 5695 either electronically via IRS e-file or by mailing a paper copy to the relevant tax authority. If you find the tax filing process to be intricate or perplexing, consider getting assistance from a tax professional. With their in-depth knowledge of tax regulations, they can ensure your claim is accurately completed and submitted.

Working with Tax Professionals

When you work with tax professionals, such as accountants or tax advisors, you gain access to their deep knowledge of tax laws and credits. Their expertise ensures that you navigate the process efficiently and don’t miss out on any credits you’re eligible for. They also bring accuracy and compliance to your tax return, thus minimizing the risk of mistakes. With a professional reviewing your documents and calculations, you reduce the chances of triggering audits or experiencing delays in receiving your credits.

In the unlikely event that you face an audit, a tax professional can offer valuable support and representation, helping you address inquiries from tax authorities. Beyond just the immediate tax return, these professionals can help you plan for the future. They can assist you in strategizing future energy-efficient improvements, which will allow you to maximize your savings through tax credits and incentives.

Smart Strategies for Getting the Most Out of Insulation Tax Credits

To maximize the benefits from your insulation tax credits you will need a well-considered combination of various available credits and incentives. In addition to the federal tax credits for energy efficiency, you may find state, local, or utility company incentives that can be claimed concurrently. These may include attractive offers such as rebates, low-interest loans, or additional tax credits; all designed to encourage energy-efficient home improvements.

Alongside insulation tax credits, you may discover a variety of other energy-related incentives and rebates. Investigate what programs are available in your locality that align with your energy-efficient objectives. These could range from incentives for solar panels and rebates for energy-efficient appliances to home weatherization programs.

When mapping out your insulation upgrades, consider combining them with other eligible energy-efficient enhancements. For instance, if an HVAC system upgrade is on the cards, schedule it to take place along with your insulation improvements for more substantial energy savings and to elevate the value of your tax credits.

For the best mix of upgrades and incentives that suit your budget and energy-saving targets, consider consulting with experts. Energy auditors, insulation contractors, or tax professionals can provide invaluable guidance.

Lastly, the timing of your upgrades can make a significant difference. Some incentives are available only within specific timeframes or subject to funding availability. Hence, meticulously planning your upgrades can help you take full advantage of the incentives at hand.

Budgeting for Insulation Upgrades

When considering an insulation project, get quotes from several contractors before you begin. By comparing prices and services, you can identify the most cost-effective option that doesn’t compromise on quality.

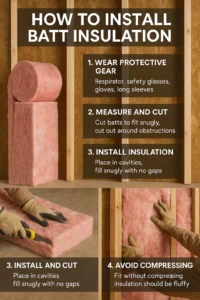

For those with the necessary skills and knowledge, some insulation projects can be undertaken as do-it-yourself endeavors. However, always prioritize safety and follow the guidelines and recommendations set forth by the manufacturer.

In terms of financing the upfront costs associated with insulation upgrades, explore all options available to you. For example, both federal and local governments or financial institutions may offer low-interest loans or energy-efficient mortgages to assist in funding these types of projects.

Finally, project the potential energy savings that could result from insulation upgrades. Understanding the long-term financial benefits can help justify the initial investment and help in making budgeting decisions more manageable. By carefully assessing all these factors, you can plan your insulation upgrades efficiently and effectively.

Planning for Future Savings

One of the key ways to ensure the longevity and effectiveness of your insulation and overall home energy systems is through regular maintenance. Carry out routine checks for wear and tear and address any issues promptly, which helps to maintain peak energy efficiency.

Monitoring your household energy consumption can be another effective strategy. Using smart energy monitors or energy tracking applications can help you analyze your energy usage and identify areas where you can achieve further improvements and cost savings.

Also, stay abreast of changes in tax credits, incentives, and advancements in energy-efficient technologies. Energy-saving programs are often revised or expanded, and being well-informed will help you seize new opportunities as they arise.

Lastly, consider setting long-term energy-saving goals for your home. Create a timeline for implementing various upgrades over time and set achievable targets. These gradual improvements can contribute to significant long-term savings, enhancing your overall financial health and making your home more environmentally friendly.

Maximizing your savings through insulation tax credits requires a strategic approach. By combining credits and incentives, budgeting wisely for insulation upgrades, and planning for future savings, you can make the most of available opportunities and enjoy both immediate and long-term financial benefits.

DIY vs. Professional Installation – How to Make the Right Choice for Your Insulation Upgrades

When it comes to insulation upgrades, homeowners are often tempted to tackle the project as a do-it-yourself (DIY) endeavor rather than hiring a professional contractor.

Deciding between DIY insulation and hiring a professional involves weighing the pros and cons while considering your skill level and project requirements. DIY insulation can be a cost-effective option for those with the necessary skills and safety precautions, while hiring a professional ensures expert installation and compliance with industry standards. By making the right choice, you can enhance the energy efficiency of your home and enjoy the benefits of a well-insulated and comfortable living space.

Pros and Cons of DIY Insulation

DIY insulation installation has its advantages and disadvantages. Understanding these can help you make an informed decision that aligns with your budget, skills, and overall project goals.

| Pros of DIY Insulation | Cons of DIY Insulation |

Cost Savings: DIY insulation can be more cost-effective, as you can avoid labor costs associated with hiring a professional contractor. Flexibility and Convenience: You can work on the project at your own pace and schedule, without relying on external contractors. Personal Satisfaction: Completing a DIY project successfully can bring a sense of accomplishment and pride in your home improvement skills. | Skill and Knowledge Requirements: Properly installing insulation requires specific knowledge and skills to ensure it is effective and up to code. Safety Risks: Working with insulation materials can expose you to hazards, such as fiberglass irritation or exposure to harmful chemicals in certain insulation types. Potential Mistakes: Incorrect installation can lead to reduced energy efficiency and decreased insulation effectiveness, negating potential cost savings. |

Benefits of Hiring a Professional

Professional insulation contractors bring a wealth of expertise and experience to the table. They possess the necessary skills to install insulation correctly, ensuring your home achieves optimal energy efficiency and performance. Moreover, they are knowledgeable about building codes and safety regulations, assuring that the insulation installation adheres to all necessary standards.

Opting for professionals can also be a time-saving decision. They can execute the installation process efficiently, preventing potential delays that may arise due to inexperience.

Another benefit of working with reputable contractors is the warranties or guarantees they often provide on their work. This means you can have peace of mind about the quality of the installation, knowing that any potential issues would be addressed under the terms of the warranty or guarantee.

For all these reasons, hiring a professional insulation contractor can add significant value to your insulation upgrade process.

How to Find Qualified Contractors

To find reliable and qualified insulation contractors, seek recommendations from friends and family or explore online reviews. Looking into the credentials and certifications of potential contractors can also offer valuable insights. Prioritize contractors who are licensed, insured, and hold certifications from relevant industry organizations. For instance, a certification from the Building Performance Institute (BPI) can be a strong indicator of the contractor’s commitment to quality and professionalism.

Asking for references from previous customers is another good idea, allowing you to gauge the contractor’s track record and level of customer satisfaction.

Lastly, seek contractors who have specific experience with energy-efficient home improvements and insulation. Such professionals can offer valuable insights and recommendations, guiding you in optimizing your energy savings through strategic insulation upgrades.

Benefits of Insulation Upgrades

Insulation upgrades come with a multitude of benefits that reach beyond immediate cost savings. A significant reduction in energy bills is perhaps the most direct result of these upgrades. By minimizing heat transfer, high-quality insulation that’s properly installed keeps your home cooler during summer and warmer during winter, leading to lower energy consumption and utility bills.

The benefits, though, don’t stop at cost savings. Insulation enhances overall comfort at home by creating a more consistent indoor temperature. This helps eliminate drafts, cold spots, and excessive heat, making your living environment cozier and more inviting.

From an environmental perspective, insulation upgrades contribute to conservation efforts. Less energy waste from inefficient insulation means a decreased demand for energy production, resulting in reduced greenhouse gas emissions and a smaller ecological footprint.

These upgrades can also significantly impact the value of your property. Energy-efficient homes are increasingly desirable in the real estate market, so investing in insulation upgrades can increase your property’s resale value and appeal to environmentally-conscious buyers.

Although the initial costs of insulation upgrades may seem high, the long-term savings in energy bills and tax credits make it a financially sound decision. Over time, these savings accumulate, offering an impressive return on investment.

Eligible Insulation Types

To claim insulation tax credits, use insulation materials that meet the eligibility criteria set by the government. Typically, the following types of insulation are considered eligible:

- Fiberglass Insulation

- Cellulose Insulation

- Spray Foam Insulation

- Mineral Wool Insulation

Always ensure that the insulation products you use are certified as meeting the required standards to qualify for tax credits.

FAQs

What are insulation tax credits?

Insulation tax credits are financial incentives offered by governments to homeowners who make energy-efficient improvements, particularly in insulation upgrades. These credits provide a direct reduction in the amount of income tax owed, encouraging homeowners to invest in energy-saving upgrades.

Are there limitations on the tax credits?

Yes, there are limitations on insulation tax credits. The credit percentage and maximum credit amount are typically capped, and there may be lifetime limits on the total amount of energy-related tax credits a homeowner can claim.

Can I claim insulation tax credits for a rental property?

No, insulation tax credits are generally available only for improvements made to a primary residence. Rental properties and vacation homes are typically not eligible for these credits.

Is there an income limit to claim insulation tax credits?

While insulation tax credits do not have income limits, some other energy-related tax credits might have phase-out thresholds based on income levels. Check with your tax advisor or the specific tax authority for details.

Are insulation tax credits the same as deductions?

Unlike deductions that lower taxable income, tax credits provide a direct reduction in the tax owed. Insulation tax credits can lead to more substantial savings compared to deductions.

Do insulation tax credits only apply to new homes?

Insulation tax credits can be claimed for energy-efficient upgrades made to existing homes, as long as they meet the eligibility criteria.

Are insulation upgrades expensive and not worth the investment?

While insulation upgrades may have upfront costs, the long-term energy savings and tax credits often outweigh the initial expenses, resulting in significant overall savings.

Are Insulation tax credits only available in certain states or regions?

Insulation tax credits are commonly available in various countries and regions as part of energy-saving initiatives. However, the specific credit amounts and requirements may vary.

Is DIY insulation always eligible for tax credits?

To claim insulation tax credits, DIY installations must meet the same energy efficiency standards as professional installations. Incorrect DIY installations may not be eligible for credits.

Here you can find more FAQs on Home Improvement Credits.

Take advantage of insulation tax credits to create a more energy-conscious and sustainable home while contributing to a greener future. Since 2013, Pure Eco Inc has been an industry-leading home improvement company, in partnership with over 150 of our subsidiaries and affiliates. We’ll be happy to answer all questions related to insulation tax credits in California. Just call us at (877) 870-7998!